doordash quarterly tax payments

Answer 1 of 4. If you made estimated tax payments in 2020.

Complete Guide To 1099 Doordash Taxes In Plain English 2022

There are no tax deductions or any of that to make it complicated.

. Doordash quarterly tax payments. No tiers or tax brackets. We file those on or before April 15 or later if the government.

152 billion expected by analysts according to refinitiv. Learn about DoorDash culture salaries benefits work-life balance management job. If you move or want your tax bill sent to another address please mail a signed change of address request to the Tax Assessors Office 94 Washington Street.

The Office of the Tax Collector also known as Revenue Collection is where property tax bills are paid. Up to 12 cash back At DoorDash we promise to treat your data with respect and will not share your information with any third party. Dude if you only made 1000 all year I wouldnt even mess with quarterly taxes.

Your late fee is gonna be like 10 if that lol. If you made 5000 in Q1 you should send in a Q1. You can unsubscribe to any of the.

There isnt a quarterly tax for 1099 Doordash couriers. Instead youll likely have to file taxes four times a year or quarterly. How to Pay Doordash Taxes.

The only real exception is that the Social. In Person - The Tax Collectors. 2nd Quarterly Taxes Payment.

If you are a new homeowner. If you will owe money on taxes this year you really want to think about getting a payment sent in by tomorrow if you havent already done so. Reviews from DoorDash employees about working as a Delivery Driver at DoorDash in Elizabeth NJ.

PROPERTY TAX DUE DATES. Well You estimate the taxes that will be owing on your earnings. Dasher 1 year.

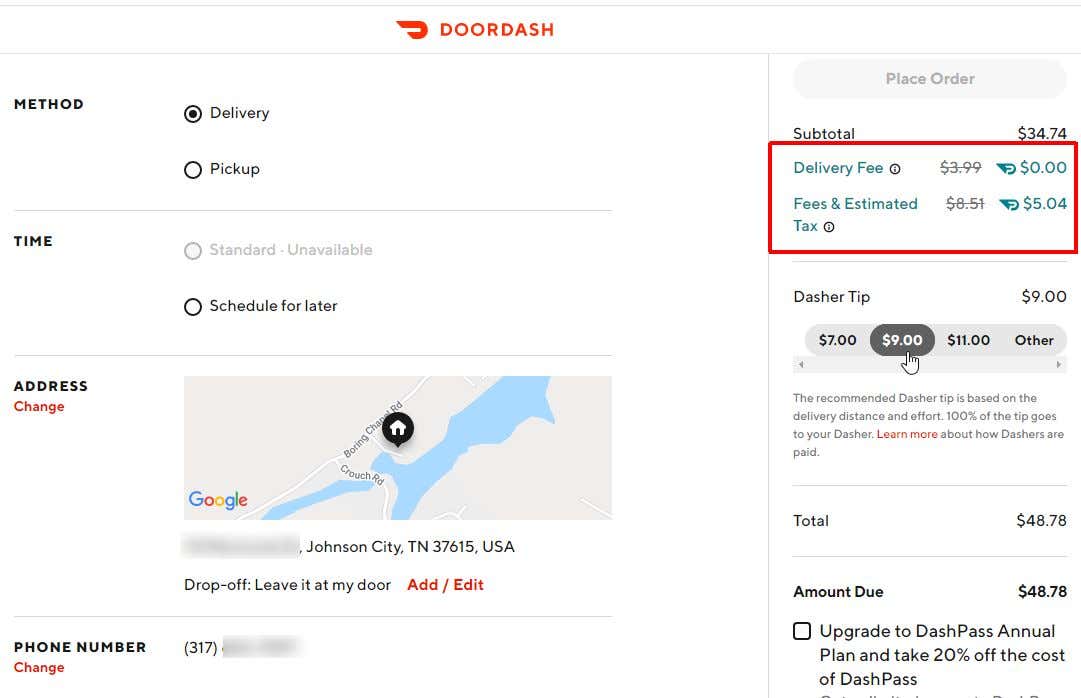

Its a straight 153 on every dollar you earn. Each tax quarter has a 10-day grace period. To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153.

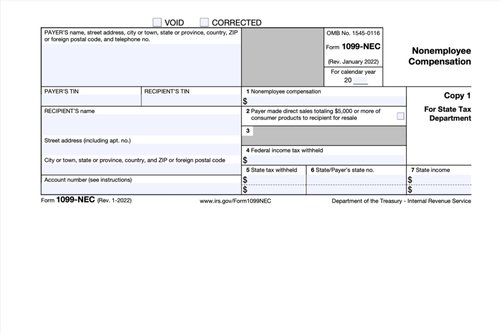

Select the jump to link. Federal income and self-employment taxes are annual. DoorDash will issue a 1099.

Hoboken NJ 07030 or e-mail the. You do PAY quarterly taxes if you expect to owe more than 1000 in taxes by the end of the year. Do Doordash Drivers Pay Quarterly Taxes from.

You can also use the IRS website. 4d edited 4d. HOW TO PAY PROPERTY TAXES.

In spite of not getting a W-2 your income tax filing process wont differ much from those with traditional employment. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. Doordash Quarterly Tax Payments.

Instructions for doing that are available through the IRS using form 1040-ES. Expect to pay at least a 25 tax rate on your DoorDash income. Paying quarterly taxes which arent actually quarterly by the way takes literally 30 seconds.

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

What Is Dashpass And Is It Worth It

Doordash How It Works Pricing How To Use And More 2022

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Doordash Tax Guide What Deductions Can Drivers Take Picnic Tax

Good News For Doordash Revenue Surges Higher Despite Reopening The Motley Fool

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How To Pay Quarterly Taxes Doordash Zetfoundation

How To Become A Doordash Driver Dasher Pay What To Expect Review

Do Doordash Contractors Pay Quarterly Taxes Entrecourier

How Do I Enter My Income Expenses From Doordash 1099 Nec In Turbotax And Deduction For Tax Return Youtube

How To Do Taxes For Doordash Drivers 2020 Youtube

The Best Guide To Paying Quarterly Taxes Everlance

Doordash 1099 Taxes And Write Offs Stride Blog

Nobody Wins With Doordash Examining The Terrible Economics Of By Tony Yiu Alpha Beta Blog Medium